Income Tax Slab For Ay 2025-25. The income tax and the tariff shall be further increased by a health and education cess calculated at 4% of such income tax and surcharge. In india, income tax is calculated using income tax slabs and rates for the applicable financial year (fy) and assessment year (ay).

The option to choose the regime can be exercised every year directly in the itr. Income above a certain limit in a financial year is taxable.

Tax Slab Rate Calculation for FY 202324 (AY 202425) with, An individual has to choose between new and old tax regime to calculate their income tax liability, subject.

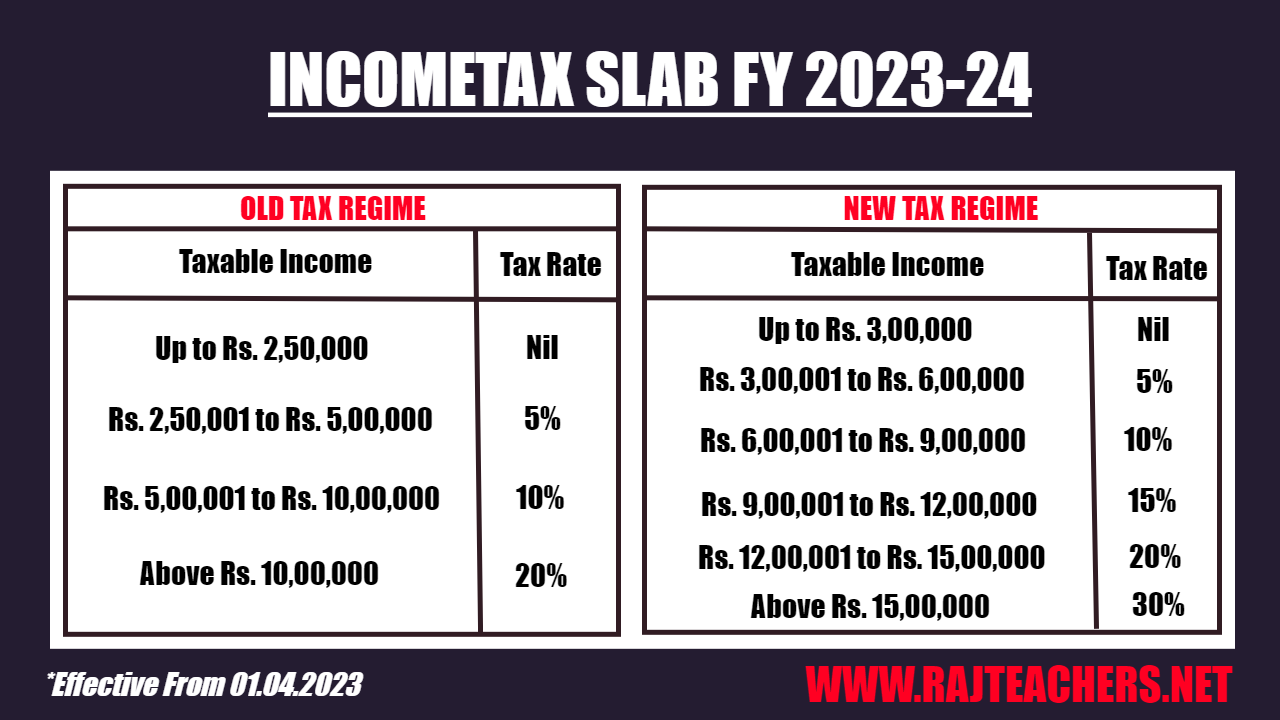

Tax Rates For Ay 202425 New Regime Sonia Eleonora, Compare the old and new income tax regimes in the blog.

Tax Slab Rate FY 202324 (AY 202425) in Budget 2025 FM, Income above a certain limit in a financial year is taxable.

Know the New Tax Slab Rates for FY 202324 (AY 202425, 3 lakh, and rising to 30% for incomes above rs.

Budget 2025 Here are the fresh new tax regime slabs India Today, The old tax regime and the new tax regime.

Tax Slab For Ay 202526 New Regime Ursa Rachele, Income above a certain limit in a financial year is taxable.

Tax Calculator Ay 202525 For Company Etty Maurise, An individual has to choose between new and old tax regime to calculate their income tax liability, subject.